Under the ice of the global copper market, the "undercurrent" is brewing?

Entering the second quarter, the global copper price has always maintained a narrow range of fluctuations, calm, and the characteristics of a balanced market are very obvious. The lack of core driving force in the global economic engine rotation market is the core factor leading to the current situation.

The economic operations of the three major economies in China, the United States and Europe are uneven, the Fed and the Bank of England are expected to raise interest rates in the second half of the year, the impact of the Sino-US trade dispute negotiation process, the United States' withdrawal from the Iran nuclear agreement triggered the geopolitical turmoil in the Middle East, LME and SHFE copper stocks The continuous increase has caused the market's long and short forces to entangle and ebb and flow with each other, and the copper price has thus fallen into range fluctuations.

Under the ice, undercurrents surged. Behind the relative balance of copper prices, some forces are gradually gathering, and there are still rising conditions for copper prices in the bull market after an upward breakthrough. The rotation of the global economic engine gradually makes the US factor dominate, and its driving potential will also play a role. The global economic recovery will still be the core of boosting consumption. On the supply side, labor-management negotiations in Chile's copper mines and the agreement-based follow-up that triggered global copper mines are still the biggest variables in the future. The current tight balance of the global copper market may be broken in the future. Therefore, we believe that the future rise of copper prices has not changed, and a rebound in the second half of the year is still a high probability event.

1. Global copper supply and demand maintain a tight balance According to the latest monthly report data from the World Metal Statistics Bureau, the global copper market supply gap from January to March 2018 was 158,000 tons, which was lower than the 235,000 tons gap in 2017. Global mine copper production from January to March this year was 4.9 million tons, an increase of 3.9% over the same period in 2017. From January to March, global refined copper production was 5.8 million tons, an increase of 3.1% over the same period last year. China and Chile increased significantly, increasing by 74,000 tons and 25,000 tons respectively.

Although the global refined copper supply gap in the first quarter of this year has narrowed compared to the same period last year, we believe that in the second half of this year, with the labor negotiation prospects of Chile’s largest copper mine, there are still variables and may be the same as in the first half of 2017. The strike event caused a slowdown in the growth of global refined copper supply, and China was affected by the tightening of copper scrap import policy, which caused the consumption of scrap copper to shift to refined copper. At the same time, the domestic new refined copper production capacity could not be fully filled. The infrastructure policy will be officially launched in the second half of the year and will stimulate the growth of copper consumption in the United States. This year, the tight balance of global copper supply and demand may change.

2. On the supply side, there are still variables in labor negotiations in Chile's copper mines. The labor strike in 2017 led to a deficit in the copper market. The market expects that many large miners will reach an agreement with their employers this year to avoid supply disruptions. This year, Chile has 32 labor-management negotiation contracts to be negotiated, accounting for about three-quarters of Chile's copper production and one-fifth of global production. So far, many mining companies and unions have reached early agreements, sending a positive message to those concerned about supply disruptions. At present, everyone's eyes are focused on another round of negotiations at Escondida, the world's largest copper mine. The company and approximately 2,500 employees on behalf of the company participated in the negotiations that began in mid-April and initially planned to start the second round of negotiations in July. The union members of Escondida had already started labor negotiations. After a record 44-day strike broke out at the mine last year, the government and company leaders seem to have adopted a more moderate approach to negotiations. However, Diego Hernandez, head of the Chilean Mining Association, believes that Chile may avoid all potential major strikes this year because both sides of the negotiations have lowered their wage expectations. After Antofagasta signed the most generous bonus contract for its miners in Chile in years, the strike at Los Pelambres mine has been successfully avoided.

At the same time, the annual reports of major mining companies around the world show that copper production has shrunk to a certain extent in 2017. The output of eleven mining companies in 2017 was 10.96 million tons, a year-on-year decrease of 3.8% from 11.37 million tons in 2016. There are many influencing factors. Among them, the most interesting is that in February last year, the union workers of the Escondida copper mine in Chile, the world’s largest copper mine, held a one-and-a-half month strike in protest against the company’s layoffs, which led to a decline in the copper output of BHP Billiton and Rio Tinto. The magnitude is larger. In addition to the intensification of conflicts between workers and enterprises, which has caused frequent strikes, most of the annual reports of most enterprises also mentioned that the average taste of their copper mines has declined, the high-quality mineral resources are gradually depleted, and the funds invested in maintaining production have increased. Problems such as rising production costs. Despite the decline in production, the increase in prices offset this part of the unfavorable factors. In 2017, the price of the LME March futures contract rose from US$5542.5/ton at the beginning of the year to US$7251.5/ton at the end of the year, an increase of 30.8%, making the performance of mining companies unexpected. With substantial year-on-year growth in revenue and considerable profits, from the perspective of the principle of profit-seeking capital, additional investment seems to be an inevitable event. We can see that major mining companies still tend to allocate more resources to copper, and the supply will increase in the future. Generally speaking, the increase in investment in copper mines shows that they are more optimistic about future price expectations, while copper ore grades Choice is another important factor in copper supply and deserves attention.

3. China's refined copper supply gap will expand slightly. As the world's largest copper consumer, China's copper consumption in the first quarter of this year was affected by the continued suppression of the real estate market and the further slowdown of investment growth in the State Grid. At the same time, the country will add 1.28 million tons of refined copper production capacity this year. On the other hand, this year’s further tightening of the country’s scrap copper import policy will shift part of the domestic copper scrap supply gap to refined copper. For a certain period of time and will not run at full capacity, the new production capacity this year is not enough to fully compensate for the consumption of copper scrap converted to refined copper.

In mid-April, the Ministry of Ecology and Environment announced on its website the "Announcement on Adjusting the Imported Waste Management Catalog" jointly issued by the Ministry of Ecology and Environment, the Ministry of Commerce, the National Development and Reform Commission, and the General Administration of Customs. The announcement shows that the import of 16 types of solid waste, including scrap metal, scrap boats, compressed parts of scrap cars, smelting slag, and waste plastics from industrial sources, will be banned, and it will be implemented from December 31, 2018. This means that the policy of banning the import of seven types of copper scrap at the end of this year, which was announced in July last year, has officially landed! In 2017, the imported copper scrap (physical quantity) was 3.558 million tons, which is 1.494 million tons after the conversion of copper content. Among them, the seven types of copper scrap are about 700,000 tons, which is a significant increase from 2016. Combined with this month, the Solid Waste Center of the Ministry of Environmental Protection In the twelfth batch of restricted imports of solid waste approvals, 11,822 tons of copper-related enterprises have been approved. The first twelve batches of restricted copper import approval quotas in 2018 totaled 482,400 tons, compared with the total amount of approvals issued last year. This year’s approval volume fell by 83.9% year-on-year. This means that even considering the pre-dismantling of some overseas factories (the current progress is not smooth, only a few large-scale enterprises have built or have intentions, most small and medium-sized Recycling or dismantling companies are still waiting to see, and even considering exiting the industry), as well as the increase in the import volume of six types of scrap copper and the increase in domestic scrap copper recycling, it is likely to be affected by the prohibition of the seven types of scrap imports in 2019. About 300,000-400,000 tons of copper scrap supply.

At the same time, customs data also showed that China's copper scrap imports in March were 220,000 tons, a cumulative decline of nearly 5.9% year-on-year from January to March.

4. The increase in global consumption will come from the United States. The launch of the infrastructure plan in the second half of the year will stimulate copper consumption demand. From the perspective of Trump’s behavior and the fulfilment of the promises he made before taking office, we believe that although his infrastructure policy has not been launched so far, it can be expected that his infrastructure policy will be at the end of the third quarter of this year. To be launched in the middle of the fourth quarter, this is mainly based on its consideration of winning votes for the mid-term elections to keep the presidential throne.

According to data from the World Bureau of Metal Statistics, the total global consumption of copper in 2017 was 23.733 million tons, of which the United States consumed 1.781 million tons, accounting for 7.5%, second only to China. From the perspective of the proportion of domestic copper consumption in various industries in the United States, the construction industry Accounted for 44%, ranking first.

Judging from the current changes in the real estate market in the United States, on the one hand, although the number of new housing starts and construction permits in the United States fell from the previous month in April, and the current number of new housing starts and construction permits in the United States as a whole is at least 40% lower than the peak in 2005-2006, but In terms of building permits, building permits for single-family houses in the United States increased by 0.9% in April to 859,000 single-family houses under construction rose by 1% to the highest total since June 2008, indicating that the core of the US new home market remains unchanged steady. On the other hand, judging from the current changes in the sales of new homes and existing homes in the United States, both are showing a steady upward trend. On the whole, the current US real estate market is still healthy. It can be expected that the US Trump administration The introduction of infrastructure policies from the end of the third quarter to the middle of the fourth quarter, the US real estate market will continue to recover, which will further drive the recovery of copper consumption in the United States.

5. The current market structure shows that the copper market is still optimistic. Looking at the changes in the market structure, LME and CFTC's copper fund positions have been competing fiercely between longs and shorts since the beginning of this year, but fund positions still maintain a net long position; while LME Copper Long-term expected pricing still maintains a premium structure, showing an upward shift in the focus of consumption. The rising momentum of stock exchanges has seen some positive changes and also provided some support for copper prices.

To sum up, the balanced market of global copper prices since the beginning of the year shows the global economic driving cycle and the weak balance of supply and demand. However, both supply and demand have variable conditions in the second half of the year. The conditions of the balanced market may be affected. If it breaks, copper prices will gain support and move up again.

Link to this article: Under the ice of the global copper market, the "undercurrent" is brewing?

Reprint Statement: If there are no special instructions, all articles on this site are original. Please indicate the source for reprinting:https://www.cncmachiningptj.com

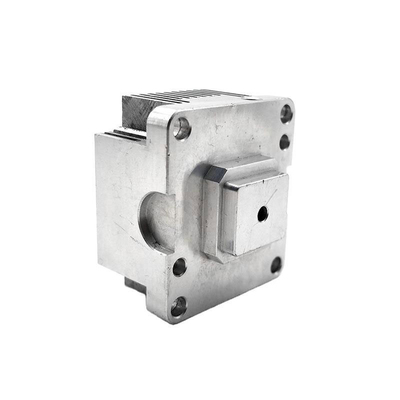

PTJ® provides a full range of Custom manufacturer of precision fabricated parts made from aluminum parts, brass parts, bronze, copper parts, high yield alloy, low carbon steel investment casting, high carbon steel and stainless steel alloy. Capable of handling parts up to +/-0.0002 in. tolerance. Processes include cnc turning, cnc milling, laser cutting,.ISO 9001:2015 &AS-9100 certified.

PTJ® provides a full range of Custom manufacturer of precision fabricated parts made from aluminum parts, brass parts, bronze, copper parts, high yield alloy, low carbon steel investment casting, high carbon steel and stainless steel alloy. Capable of handling parts up to +/-0.0002 in. tolerance. Processes include cnc turning, cnc milling, laser cutting,.ISO 9001:2015 &AS-9100 certified.

Tell us a little about your project’s budget and expected delivery time. We will strategize with you to provide the most cost-effective services to help you reach your target,You are welcome to contact us directly ( [email protected] ) .

- 5 Axis Machining

- Cnc Milling

- Cnc Turning

- Machining Industries

- Machining Process

- Surface Treatment

- Metal Machining

- Plastic Machining

- Powder Metallurgy Mold

- Die Casting

- Parts Gallery

- Auto Metal Parts

- Machinery Parts

- LED Heatsink

- Building Parts

- Mobile Parts

- Medical Parts

- Electronic Parts

- Tailored Machining

- Bicycle Parts

- Aluminum Machining

- Titanium Machining

- Stainless Steel Machining

- Copper Machining

- Brass Machining

- Super Alloy Machining

- Peek Machining

- UHMW Machining

- Unilate Machining

- PA6 Machining

- PPS Machining

- Teflon Machining

- Inconel Machining

- Tool Steel Machining

- More Material