The largest reduction in tariffs on automobiles is 40%, and the aluminum industry is concerned

Yesterday evening, the Customs Tariff Commission of the State Council issued the "Announcement on Reducing Import Tariffs on Automobiles and Parts".

According to the announcement, in order to further expand reform and opening up, promote supply-side structural reforms, promote the transformation and upgrading of the auto industry, and meet the consumer demand of the people, starting from July 1 this year, import tariffs on automobiles and parts will be reduced. Reduce the tax rates of 135 tax numbers with a tax rate of 25% and 4 tax numbers with a tax rate of 20% to 15%, and reduce the tax rates of auto parts to 8%, 10%, 15%, 20%, and 25 The tax rate for a total of 79 tax lines has been reduced to 6%.

According to a reporter from the Futures Daily, this time my country will reduce automobile import tariffs to a considerable extent. For example, starting from July 1 this year, the tariffs on vehicles with a tax rate of 25% and 20% will be reduced to 15%. 40% and 25%; the tariffs on auto parts with tax rates of 8%, 10%, 15%, 20%, and 25% are reduced to 6%, and the average tax reduction rate is 46%.

my country maintains the multilateral trading system. The reduction of automobile import tariffs this time is a major measure for my country to further expand its reform and opening up. After the tax reduction, the average tax rate for complete vehicles in my country is 13.8%, and the average tax rate for parts and components is 6%, which is in line with the reality of my country's auto industry. A considerable reduction in automobile import tariffs will help promote supply-side structural reforms, promote structural adjustment and transformation and upgrading of the automobile industry, guide the quality and efficiency of automobile products, enrich the domestic market supply, meet the diverse needs of the people, and provide domestic consumers Bring a richer and more affordable consumer experience.

On the same day, the relevant person in charge of the Office of the Customs Tariff Commission of the State Council answered questions from reporters on reducing import tariffs on automobiles and parts. The content is as follows:

One question: Can you give us a detailed introduction to the tax reduction plan?

Answer: According to the "Import and Export Tariffs of the People's Republic of China", there are a total of 178 tax numbers for complete vehicles in my country. The average MFN arithmetic tax rate before tax reduction is 21.5%, and the tax rate is between 3% and 25%. Among them: the tax rate for 135 tax numbers is 25%, including small passenger cars with 9 seats or less, large and medium-sized passenger cars, and light trucks weighing 5 tons or less; the tax rate for 4 tax numbers is 20%, including vehicles weighing more than 5 tons Gasoline trucks, diesel trucks weighing between 5 tons and 20 tons; the tax rate for the 4 tax numbers is 15%, including diesel trucks weighing more than 20 tons, concrete mixer trucks, and some crane trucks; The tax rate for 10 tax codes is 12%, including some special purpose vehicles such as drilling trucks and environmental monitoring vehicles; the tax rates for the remaining 25 tax codes are 10%, 9%, 8%, 6%, 4%, and 3%, respectively. Including road tractors, tractors, ramp passenger cars, freight dump trucks, etc.

This time, my country has reduced the tax rate of 135 tax lines with a tax rate of 25% to 15%, and the tax rate is reduced by 40%; the tax rate of 4 tax lines with a tax rate of 20% is reduced to 15%, and the tax rate is reduced by 25%; the remaining tax rates The tax rates of 39 tax lines of 15% and below remain unchanged.

After the tax reduction, the most-favored-nation arithmetic average tax rate for the entire vehicle in my country is 13.8%, and the tax rate ranges from 3% to 15%. Among them, the tax rate for 143 tax codes is 15%, and the tax rate for 35 tax codes is 12% and below.

There are a total of 97 tax numbers for auto parts in my country, and the most-favored-nation arithmetic average tax rate before tax reduction is 10.2%, and the tax rate is between 6% and 25%. Among them: the tax rate for 4 tax numbers is 25%, including large passenger car frames and other parts and accessories, light truck frames and other parts and accessories; the tax rate for 2 tax numbers is 20%, including large passenger car chassis and crane chassis ; The tax rate for 2 tax numbers is 15%, including non-drive axles and parts for large passenger cars, and other parts and accessories for special vehicles; the tax rate for 70 tax numbers is 10%, including automatic gearboxes, steering wheels, suspension reduction Vibrators, clutches, and parts of these components, etc.; the tax rates for the remaining 19 tax numbers are 8% and 6% respectively, including other parts such as the chassis of off-road freight dump trucks.

Second question: What are the main considerations for my country to take the initiative to lower the import tariffs on automobiles?

Answer: On April 10th, General Secretary Xi Jinping announced in the keynote speech at the opening ceremony of the Boao Forum for Asia 2018 Annual Conference that this year we will considerably reduce automobile import tariffs. Premier Li Keqiang proposed to reduce automobile import tariffs in this year's government work report. In order to actively implement the important instructions of General Secretary Jinping and the requirements of Premier Li Keqiang, the Tariff Commission of the State Council studied and drafted a tax reduction plan for automobiles in a timely manner. Mainly consider the following factors:

First, my country further expands the need for reform and opening up. This year is the 40th anniversary of my country's reform and opening up. In his keynote speech at the opening ceremony of the Boao Forum for Asia 2018 Annual Conference, General Secretary Xi Jinping emphasized that China's economic development in the past 40 years has been achieved under open conditions, and the high-quality development of China's economy in the future must also be carried out under more open conditions. This is a strategic choice made by China based on development needs. Actively expanding imports is one of China's major measures to further open up announced by General Secretary Xi Jinping. Taking the initiative to significantly reduce automobile import tariffs is conducive to expanding imports and promoting the high-quality development of the automobile industry under more open conditions.

Second, the auto industry needs to promote supply-side structural reforms and transformation and upgrading. my country's automobile industry has gradually developed and grown, forming a complete industrial system with a complete range of types and complete supporting facilities, which has a certain degree of competitiveness. However, it should also be noted that the structure of my country's automobile industry needs to be further optimized and upgraded, and innovation capabilities need to be further strengthened. At present, the new generation of information and communication, new energy, new materials and other technologies are accelerating the integration of the automobile industry, the industrial ecology is undergoing profound changes, and the competitive landscape is fully reshaped. The international competitiveness of my country's automobiles urgently needs to be improved. Tariffs are a means of protection for compliance, but tariff protection should be moderate. Lowering automobile import tariffs will help the industry to strengthen competition, adjust its structure, and accelerate transformation.

Third, to meet the needs of consumption upgrades. At present, socialism with Chinese characteristics has entered a new era, and the main social contradictions in our country have been transformed into contradictions between the people's ever-increasing needs for a better life and unbalanced and inadequate development. As far as automobile consumption is concerned, the people's consumer demand for automobiles is more diversified, and they hope that automobile products will be further improved in quality and price. The domestic automobile market needs to be further enriched. Reducing automobile import tariffs will help meet the people's growing needs for a better life, expand domestic demand, and bring more power and vitality to China's economic development.

Three questions: Domestic consumers all hope that the price of cars can be reduced. How much do you expect the price of cars to fall after the tax reduction?

Answer: The price of a car is determined by many factors, and import tariffs are only one of them. From the perspective of the price of a car, the market guide price determined by the manufacturer determines the final selling price of the car to a large extent. There is a certain connection between the tariff and the manufacturer’s market guide price. The lowering of the tariff is a factor in the price reduction, but whether the price of the car is reduced and the rate of reduction It's more or less market behavior. We aim to promote competition in the auto industry by lowering import tariffs and guide the auto industry to improve quality and efficiency. We hope that tax cuts can reduce car prices and allow consumers to get more benefits.

Take an imported car with a guide price of about 900,000 yuan in the Chinese market as an example. When the imported car has a CIF price of 240,000 yuan and a tariff rate of 25%, the tariff will be 60,000 yuan. Tariffs account for 7% of the manufacturer’s guidance price in the Chinese market. After the tax cut, the tariff rate has been reduced from 25% to 15%. This imported car will be subject to a tariff of 36,000 yuan, which is a reduction of 24,000 yuan from before the tax reduction. Affected by the reduction of tariffs, value-added tax and consumption tax on automobile import will also be reduced accordingly.

Fourth question: What is the international comparison of my country's auto tariff levels after the tax reduction? Will further reduction of import tariffs be considered in the next step?

Answer: After the tax reduction, my country's automobile import tariff rate is between 3% and 15%, which is already lower than the average level of other developing countries. Taking a horizontal comparison of small passenger cars with 9 seats or less, my country’s tariff rate is 15%, the EU’s 9.8%, South Korea’s 8%, India’s 60%, and Brazil’s 35%. In general, the tariff rate of my country's automobile after tax reduction is in line with the reality of my country's industry.

After the substantial reduction in automobile import tariffs this time, the automobile industry needs a process of gradual adaptation. Whether the entire automobile and parts will continue to reduce import tariffs will be determined mainly according to the competitiveness and development changes of the automobile industry. We will continue to implement new development concepts, promote supply-side structural reforms, promote the quality and efficiency of the auto industry, and continuously enhance the competitiveness of my country's auto industry.

Industry professionals believe that my country’s substantial reduction of import tariffs on complete vehicles and parts will inevitably have a certain degree of impact on the domestic automotive industry. The prices of domestically-produced vehicles and the high profits of spare parts will definitely be lowered, which will affect the majority of automotive users. However, it will also cause greater fluctuations in the prices of products in the upstream and downstream markets involved in the automotive industry. For the majority of futures investors, special attention should be paid to the reactions of the commodity markets such as rubber, aluminum, and plastics.

Link to this article:The largest reduction in tariffs on automobiles is 40%, and the aluminum industry is concerned

Reprint Statement: If there are no special instructions, all articles on this site are original. Please indicate the source for reprinting:https://www.cncmachiningptj.com

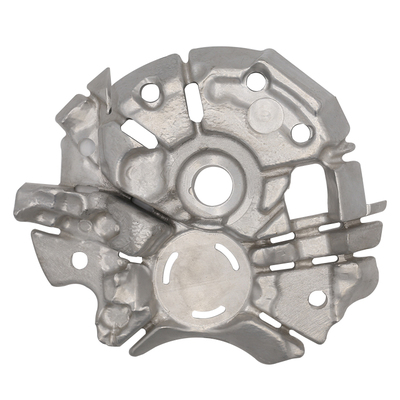

PTJ® provides a full range of Custom manufacturer of precision fabricated parts made from aluminum parts, brass parts, bronze, copper parts, high yield alloy, low carbon steel investment casting, high carbon steel and stainless steel alloy. Capable of handling parts up to +/-0.0002 in. tolerance. Processes include cnc turning, cnc milling, laser cutting,.ISO 9001:2015 &AS-9100 certified.

PTJ® provides a full range of Custom manufacturer of precision fabricated parts made from aluminum parts, brass parts, bronze, copper parts, high yield alloy, low carbon steel investment casting, high carbon steel and stainless steel alloy. Capable of handling parts up to +/-0.0002 in. tolerance. Processes include cnc turning, cnc milling, laser cutting,.ISO 9001:2015 &AS-9100 certified.

Tell us a little about your project’s budget and expected delivery time. We will strategize with you to provide the most cost-effective services to help you reach your target,You are welcome to contact us directly ( [email protected] ) .

- 5 Axis Machining

- Cnc Milling

- Cnc Turning

- Machining Industries

- Machining Process

- Surface Treatment

- Metal Machining

- Plastic Machining

- Powder Metallurgy Mold

- Die Casting

- Parts Gallery

- Auto Metal Parts

- Machinery Parts

- LED Heatsink

- Building Parts

- Mobile Parts

- Medical Parts

- Electronic Parts

- Tailored Machining

- Bicycle Parts

- Aluminum Machining

- Titanium Machining

- Stainless Steel Machining

- Copper Machining

- Brass Machining

- Super Alloy Machining

- Peek Machining

- UHMW Machining

- Unilate Machining

- PA6 Machining

- PPS Machining

- Teflon Machining

- Inconel Machining

- Tool Steel Machining

- More Material