Alumina has soared 60% this year

Due to tight supply, alumina prices may reach a record high before the end of the year. It is worth noting that in May of this year, alumina has skyrocketed by 60%. The original supply balance of the aluminum market has been broken by the United States, superimposed on the Australian strike and the suspension of production in Brazil, the supply space of the overseas aluminum market will be further compressed in the future.

According to a report in the Financial Times, the head of the mining group South32 said that the price of alumina, a key material used to make aluminum, may reach a new high before the end of the year as the supply situation has become more tight.

Wall Street Editor-in-Chief Selected "Aluminum Price Soaring" Should I miss the same story again? "It was also mentioned that the continuity of this round of rise depends more on the continuity of the strike. In the current situation of limited supply of raw materials, LME aluminum is more likely to rise but not fall.

Since the beginning of this year, the price of alumina has soared by 60% and set a record of US$650 per ton in May. Although overseas alumina has fallen slightly now, the price is still strong, about US$640/ton. The expectation of rising alumina prices will also further boost the price of electrolytic aluminum (derived from the electrolysis of alumina).

And just yesterday, the price of aluminum futures for three-month delivery on the London Metal Exchange also climbed 1.2%, closing at US$2,095 per ton. Alcoa once soared 4.1%, the largest increase in the market in the next month. Century Aluminum also It once soared 7.2%.

It is worth noting that the United States imposed sanctions on Rusal as early as April, which caused a huge impact on the global aluminum supply chain and directly pushed up the cost of global light metal producers.

Reuters previously reported that according to Rusal insiders, “if the sanctions cannot be lifted in the future, after the contract expires on October 1, the company’s products for external markets will be recalled and restocked. Considering Rusal 80 % Of the production capacity is sold to overseas markets, which is disastrous not only for the company, but also for the global aluminum market."

As the U.S. restriction date on Rusal approaches step by step, buyers are scratching their heads, looking for a "savior" that can replace Rusal's supply.

However, to the disappointment of buyers, there has been a huge "crack" in the Australian supply market that was originally the most promising.

Bloomberg previously reported that on the 8th of last month, about 1,500 workers in Australia held an indefinite strike because a new workplace agreement by Alcoa could not provide workers with adequate job security.

The Brazilian authorities also asked the local aluminum producer Alunorte factory to reduce production capacity by 50%, which further exacerbated the global alumina supply shortage.

The above-mentioned media further reported that Rusal President Oleg Deripaska continued to negotiate with the US authorities for the lifting of the sanctions. At the same time, buyers of aluminum products continue to rush to buy aluminum products to prevent the deterioration of negotiations.

Energy consulting firm Wood Mackenzie stated that if the United States continues to impose sanctions on Rusal in October, aluminum prices will face an "end of the world scenario", and the price may exceed April aluminum prices and reach a seven-year high.

In an interview with Bloomberg, Vice Chairman of Metal Mining Julian Keitel also said that there is already a deficit in markets outside of China. If Rusal cannot supply metal, there will be a "mass shortage" in the market by then.

BMO Capital Markets analyst Edward Sterck said in a recent report: “With the continued shutdown of the Alunorte plant of Norsk Hydro in Brazil and the impact of the ongoing strike at the Alcoa refinery in Western Australia, the global alumina market is expected There will be a 10% gap. Given that the current transaction price of alumina has exceeded $600, it is expected that higher transactions may be carried out before the end of the year."

Link to this article: Alumina has soared 60% this year

Reprint Statement: If there are no special instructions, all articles on this site are original. Please indicate the source for reprinting:https://www.cncmachiningptj.com

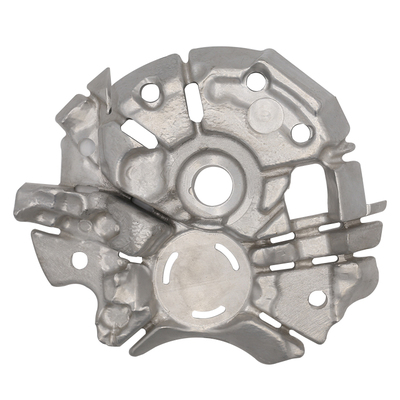

PTJ® provides a full range of Custom manufacturer of precision fabricated parts made from aluminum parts, brass parts, bronze, copper parts, high yield alloy, low carbon steel investment casting, high carbon steel and stainless steel alloy. Capable of handling parts up to +/-0.0002 in. tolerance. Processes include cnc turning, cnc milling, laser cutting,.ISO 9001:2015 &AS-9100 certified.

PTJ® provides a full range of Custom manufacturer of precision fabricated parts made from aluminum parts, brass parts, bronze, copper parts, high yield alloy, low carbon steel investment casting, high carbon steel and stainless steel alloy. Capable of handling parts up to +/-0.0002 in. tolerance. Processes include cnc turning, cnc milling, laser cutting,.ISO 9001:2015 &AS-9100 certified.

Tell us a little about your project’s budget and expected delivery time. We will strategize with you to provide the most cost-effective services to help you reach your target,You are welcome to contact us directly ( [email protected] ) .

- 5 Axis Machining

- Cnc Milling

- Cnc Turning

- Machining Industries

- Machining Process

- Surface Treatment

- Metal Machining

- Plastic Machining

- Powder Metallurgy Mold

- Die Casting

- Parts Gallery

- Auto Metal Parts

- Machinery Parts

- LED Heatsink

- Building Parts

- Mobile Parts

- Medical Parts

- Electronic Parts

- Tailored Machining

- Bicycle Parts

- Aluminum Machining

- Titanium Machining

- Stainless Steel Machining

- Copper Machining

- Brass Machining

- Super Alloy Machining

- Peek Machining

- UHMW Machining

- Unilate Machining

- PA6 Machining

- PPS Machining

- Teflon Machining

- Inconel Machining

- Tool Steel Machining

- More Material