The profits of the electrolytic aluminum industry are "rising"

The introduction of the “double carbon” policy has almost ruled out the possibility of the future release of the electrolytic aluminum supply ceiling, which has greatly eased the pressure of domestic electrolytic aluminum overcapacity.

At the same time, the lightweight feature has given the aluminum industry a new growth point. Many other fields will replace other materials, alleviating the embarrassing situation of the declining growth rate of the traditional consumption field faced by the consumer side of the aluminum industry in recent years. From a medium-term perspective, the electrolytic aluminum industry will get rid of the past overcapacity situation and welcome Come a brand-new development pattern.

Many factors promote the profitability of the electrolytic aluminum industry

The reporter saw that in recent times, the overall profit of the electrolytic aluminum industry has been "increasing." In mid-March, the profit per ton of aluminum once rose to 4,000 yuan/ton, despite the market’s rumors of “national reserve dumping reserves” that caused aluminum prices to fall. , But the current profit of the electrolytic aluminum industry is still maintained at 3000 yuan/ton, and the industry profit is at a high level in the past 10 years.

From the perspective of industry insiders, the profitability of the electrolytic aluminum industry is being driven by multiple factors. Jinrui Futures analyst Gao Weihong said that on the one hand, under the global monetary easing environment, the economic recovery and high inflationary commodity cycle have brought macro support; on the other hand, the continuous recovery of the domestic economy has driven consumption to maintain a relatively good growth rate, although there is also supply. Growth, but strong support from low inventories.

"Thanks to the supply-side reform policy in 2017, the growth rate of electrolytic aluminum production remained at a very low level until the beginning of last year, while consumption maintained rapid growth during this period. Therefore, the contradiction between supply and demand continued to expand, and aluminum ingot inventories were at a low level. Push up the price of aluminum." said Sun Weidong, an analyst at Top Securities Futures.

At the same time, the establishment of the goal of "carbon neutrality" on the policy side is a direct benefit to both the supply and demand sides of the electrolytic aluminum industry. Gao Weihong said that energy consumption control on the supply side has been reflected in Inner Mongolia, and the demand side is reflected in the long-term development of new energy fields, such as new energy vehicles, photovoltaics and other fields.

In addition, in terms of cost, the long-term oversupply of alumina has not changed. The low alumina price has kept the raw material cost low. The research report of the GF Securities Nonferrous Metals team believes that the difference in supply and demand between the upstream and downstream of the industry chain has prompted the industry to maintain high profits. Data show that the average tax-included price of nonferrous electrolytic aluminum of the Yangtze River in the first quarter of 2021 was 16,248.79 yuan/ton, a year-on-year increase of 22.3%; while the average tax-included price of alumina was 2,363.75 yuan/ton, a year-on-year decrease of 5.76%. This resulted in a substantial year-on-year increase in the profits of the electrolytic aluminum industry in the first quarter, which helped the industry's companies achieve substantial year-on-year growth.

The "scissors gap" between alumina and electrolytic aluminum prices will continue

"When the price of electrolytic aluminum continues to rise, the price of alumina continues to stay above and below the cost line, and the two prices have formed an obvious'scissors gap'." According to Sun Kuangwen, an analyst at Xinhu Futures, this is determined by the supply and demand structure of the two. .

On the one hand, the current domestic alumina production capacity has climbed to 90 million tons, while the electrolytic aluminum production capacity is only around 43 million tons. He said that although the alumina operating capacity is only at the level of 76.5 million tons, which cannot fully match the current electrolytic aluminum operating capacity of more than 39 million tons, overseas alumina can completely make up for these needs.

On the other hand, due to the high elasticity of alumina supply, once the alumina price rises above the cost line, idle production capacity can quickly resume operation, which also determines that it is difficult for alumina companies to obtain and maintain high profits. Relatively speaking, the growth of electrolytic aluminum production is limited by the ceiling of production capacity, as well as the "carbon peak" and "carbon neutral" policy constraints, and there is still a certain time lag from production capacity release to production release, which determines the short-term production increase of electrolytic aluminum. It is very difficult for the speed to exceed expectations.

Sun Weidong, an analyst at Top Securities Futures, told reporters that the essential reason for this "scissors gap" is that the alumina industry does not have supply-side reforms. While the long-term output of the electrolytic aluminum industry has maintained a low growth rate, global alumina production capacity is still expanding rapidly. The industry has built a serious overcapacity.

“It can be seen that the supply-side reform of the electrolytic aluminum industry in 2017 brought to an abrupt halt the rapid expansion of production capacity, and millions of tons of illegal production capacity were directly shut down. In 2018 and 2019, electrolytic aluminum production experienced two consecutive years of negative growth. In contrast, the alumina industry, Because there is no policy intervention, there is still a large amount of production capacity in the planning and construction stage even in the case of surplus. This severe surplus pattern needs to be corrected by independent elimination, causing alumina companies to be in a period of pain." said Liu Dongbo, an analyst at SDIC Anxin Futures. .

In Sun Weidong’s view, since alumina does not have policy constraints and there is still greater pressure for new investment, alumina prices will remain low for a long period of time in the future, and the industry will experience a long period of clearing of excess capacity. Continue to maintain a large "scissors gap." Sun Kuangwen also said that the "scissors gap" between alumina and electrolytic aluminum prices will continue, and the possibility of expansion due to the restart of idle alumina production capacity is not even ruled out.

The contradiction between supply and demand under seasonal de-stocking in the second quarter is not prominent

On the whole, Liu Dongbo said that in a state of high profit, there are still many electrolytic aluminum production capacity to be newly invested and resumed this year. It is inevitable that electrolytic aluminum production capacity will gradually increase. In addition, there is the supplement of imported sources, and the pressure on the supply side still exists. . The peak season consumption is also relatively optimistic, but the pace is different from last year. At present, the overall contradiction between supply and demand is not as obvious as last year, and seasonal destocking is expected to continue.

Sun Kuangwen said that with the arrival of the traditional consumption season, the overall domestic aluminum market consumption has shown a clear upward trend. Among them, the seasonal improvement of aluminum profile consumption in the real estate sector is obvious, and the strong growth momentum of the automobile market, especially new energy vehicles, continues to drive transportation. The consumption of aluminum has grown. However, the consumption momentum of this year's peak season may not be as good as that of the same period in previous years. Due to the high aluminum price, the processing cost has risen. In the case of the terminal market's low price acceptance, the profits of processing companies are squeezed, and the shrinking cash flow inhibits their willingness to replenish inventory. Therefore, even in the current situation where the downstream raw material inventory is very low, the pattern of tight supply is still not obvious.

Sun Weidong told reporters that higher aluminum ingot prices have significantly inhibited the willingness to purchase downstream, and this inhibition has been stronger than in previous rounds of increases. He said that since the price of aluminum exceeded 10,000, the transmission pressure to the downstream has increased significantly. On the one hand, the general rise in bulk commodities has greatly increased terminal costs, which has formed a certain crowding effect on consumption; on the other hand, domestic demand after the epidemic The repair momentum has gradually weakened, so the downstream tolerance for the upward price of raw materials is also decreasing.

Liu Dongbo predicts that the aluminum market will continue to go to warehouses in the second quarter of this year, but the speed of going to warehouses may be slower than last year. At present, the social inventory of aluminum ingots is 1.2 million tons, and the speed of destocking is not too fast. There is no shortage of supply for the time being. This can also be reflected in the structure of spot discounts and monthly differences. On the whole, he believes that the inventory is expected to return to a low level in the second quarter, and the spot premium may rise, but the market may not reach the level of tension last year. It is also necessary to pay attention to whether the State Reserve's aluminum dumping will land.

However, in Gao Weihong's view, although short-term high aluminum prices have a certain inhibitory effect on consumption, rigid demand cannot be curbed in the long-term, prices will gradually be transmitted to the downstream, and overall demand expectations are better. On the supply side, there are also new investment and production resumption expectations in the second quarter, so supply and demand will be in a double-boom situation. From the perspective of rhythm, he believes that the boost in the peak consumption season may come faster. Recently, the sentiment of spot purchases has improved significantly, and the signs of the peak season have begun to appear. However, due to the production characteristics, the new production capacity is gradually released on the supply side, so it will be relatively slow. From the perspective of the balance sheet, he expects that the second quarter will most likely be in a state of destocking, but it is also necessary to pay attention to the State Reserve’s dumping of aluminum. Once the magnitude is 200,000-300,000 tons and above, the supply and demand gap will be filled.

Looking ahead, Gao Weihong believes that aluminum prices will continue to run at a high level. However, due to the high level of profit in the industry, it is difficult to see obvious benefits in the short-term macro, and the pressure of the State Reserve to sell aluminum has not been lifted. It is expected to maintain strong oscillations. From the perspective of the operating range, Liu Dongbo believes that the Shanghai aluminum limit on March 23 was at 16,500 yuan/ton or the recent bottom area, and the top may be difficult to break through the 2011 high. He suggested that downstream companies buy virtual inventory below Wanqi, and electrolytic aluminum production companies gradually increase the value-holding ratio around Wanba to lock in profits.

According to Sun Weidong, the upward driving force of aluminum prices this year should come from overseas, because overseas supply pressure is small and the certainty of consumption recovery is higher than that of domestic consumption. If there is a strong recovery in overseas consumption in the second quarter, domestic aluminum prices may break through. "Currently, aluminum prices are hovering between Wanqi and Wanba. Due to the impact of domestic carbon emission policies, supply pressure in the second quarter is not expected to be large, and there is still room for some restoration of consumption. Therefore, domestic supply will be relatively tight until at least June. In this situation, the overall price is expected to continue the trend of strong oscillation. However, since Wanba has been a strong resistance level for many years, it is expected that the domestic supply gap in the second quarter will not be enough to support the long-term price movement above Wanba."

"Dual Carbon" Goal and Long-term Vision under New Energy Consumption

Ge Honglin, member of the Standing Committee of the National Committee of the Chinese People’s Political Consultative Conference, Secretary of the Party Committee and Chairman of the China Nonferrous Metals Industry Association, stated that the "Implementation Plan for Carbon Peak in the Non-ferrous Metals Industry" is currently seeking the opinions of industry associations and enterprises. Peak, strive to achieve 40% emission reduction by 2040. This plan is at least five years ahead of the national carbon peak time.

He proposed that the non-ferrous metal industry should take more proactive actions to help achieve the national "dual carbon" goal. One is to further strictly control the overcapacity of electrolytic aluminum ceiling and copper, lead and zinc smelting capacity, increase the proportion of clean energy use, expand the use of recycled non-ferrous metals, and strive to be more advanced in the industry's carbon peak. The second is to further develop and apply green carbon reduction technologies, and strive to reduce carbon emissions even faster after reaching the peak. In short, it is necessary to show the new image of nonferrous metals with the effects of green development.

Gao Weihong said that the setting of the "dual carbon" goal is conducive to the long-term and healthy development of the electrolytic aluminum industry, and of course it also brings considerable opportunities and challenges. First of all, under the requirements of the "dual carbon" target, the aluminum industry, as a high-energy-consuming industry, is under great pressure to reduce emissions, and may even face the problem of carbon emission costs in the future. In some areas where energy consumption exceeds the standard, production is forced to reduce, forcing companies to accelerate energy conservation. Technological development in emission reduction.

Sun Kuangwen told reporters that the current domestic use of electrolytic aluminum thermal power accounts for about 86%, and the use of clean energy accounts for only about 14%, which is far from the 75% overseas use of clean energy. Therefore, the domestic electrolytic aluminum production capacity is gradually shifting to regions rich in clean energy. In addition, since the energy consumption of secondary aluminum is only about 5% of primary aluminum, the realization of the "dual carbon" goal is conducive to promoting the development of the domestic secondary aluminum industry.

On the other hand, the “dual-carbon” background and the demand for light weight have allowed the market to give the aluminum smelting industry more profit margins, which is conducive to the substantial improvement of corporate profits, with more sufficient capital for technological research and development, product innovation, etc., to further improve related The added value of products, especially in terms of light weight and low carbonization, makes the products of domestic enterprises more competitive, including high-end aluminum alloy materials.

Sun Kuangwen said that the "dual-carbon" target provides greater growth momentum for aluminum consumption. Among them, the growth of photovoltaic aluminum and aluminum for new energy vehicles is particularly prominent, and the long-term domestic aluminum consumption structure will undergo a significant change. It is estimated that by the end of the "14th Five-Year Plan", domestic aluminum consumption for photovoltaics will reach 1.67 million tons, accounting for nearly 4% of total consumption from the current level of 2%. At the same time, according to the new energy vehicle development plan, the proportion of domestic new energy vehicles will reach 20% in 2025, which means that the domestic new energy vehicle output will maintain a growth rate of more than 30% during the "14th Five-Year Plan" period. The amount of aluminum will rise from the current 390,000 tons to 1.57 million tons, and its share in total consumption will also rise from below 1% to 3.6%.

On the whole, Sun Weidong said that the introduction of the "dual carbon" policy has almost ruled out the possibility of the future release of the electrolytic aluminum supply ceiling, which has greatly eased the pressure of domestic electrolytic aluminum overcapacity, and will gradually reach the supply bottleneck within two to three years. At the same time, the lightweight nature has given the aluminum industry a new growth point, and it will substitute other materials in many fields such as new energy vehicles, alleviating the embarrassing situation of the continuous decline in the growth rate of the traditional consumption field faced by the aluminum industry in recent years. From a medium-term perspective, the electrolytic aluminum industry will get rid of the past overcapacity situation and usher in a new development pattern.

Link to this article: The profits of the electrolytic aluminum industry are "rising"

Reprint Statement: If there are no special instructions, all articles on this site are original. Please indicate the source for reprinting:https://www.cncmachiningptj.com/,thanks!

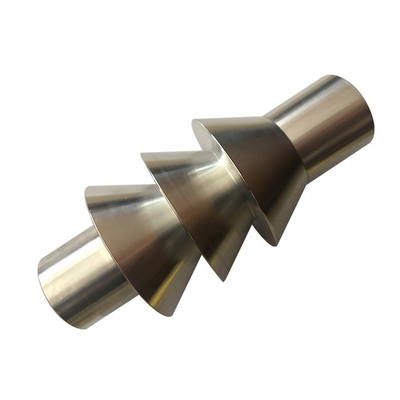

PTJ® provides a full range of Custom Precision cnc machining china services.ISO 9001:2015 &AS-9100 certified. Large scale machining Manufacturer of medical bags, providing 3D design, prototype and global delivery services. Also offering hard cases, semi-hard EVA, soft-sewn cases, pouches and more for OEMs. All cases are made custom according to specifications with infinite combinations of materials, molds, pockets, loops, zippers, handles, logos and accessories. Shockproof, water-resistant and eco-friendly options. Medical parts, emergency response, Electronic parts, corporate, education, military, security, sports, outdoors and construction industries. Services include case concept consultation, 3D design, prototyping,rototyping,CNC Drilling Services and manufacturing.Tell us a little about your project’s budget and expected delivery time. We will strategize with you to provide the most cost-effective services to help you reach your target,You are welcome to contact us directly ( [email protected] ) .

PTJ® provides a full range of Custom Precision cnc machining china services.ISO 9001:2015 &AS-9100 certified. Large scale machining Manufacturer of medical bags, providing 3D design, prototype and global delivery services. Also offering hard cases, semi-hard EVA, soft-sewn cases, pouches and more for OEMs. All cases are made custom according to specifications with infinite combinations of materials, molds, pockets, loops, zippers, handles, logos and accessories. Shockproof, water-resistant and eco-friendly options. Medical parts, emergency response, Electronic parts, corporate, education, military, security, sports, outdoors and construction industries. Services include case concept consultation, 3D design, prototyping,rototyping,CNC Drilling Services and manufacturing.Tell us a little about your project’s budget and expected delivery time. We will strategize with you to provide the most cost-effective services to help you reach your target,You are welcome to contact us directly ( [email protected] ) .

- 5 Axis Machining

- Cnc Milling

- Cnc Turning

- Machining Industries

- Machining Process

- Surface Treatment

- Metal Machining

- Plastic Machining

- Powder Metallurgy Mold

- Die Casting

- Parts Gallery

- Auto Metal Parts

- Machinery Parts

- LED Heatsink

- Building Parts

- Mobile Parts

- Medical Parts

- Electronic Parts

- Tailored Machining

- Bicycle Parts

- Aluminum Machining

- Titanium Machining

- Stainless Steel Machining

- Copper Machining

- Brass Machining

- Super Alloy Machining

- Peek Machining

- UHMW Machining

- Unilate Machining

- PA6 Machining

- PPS Machining

- Teflon Machining

- Inconel Machining

- Tool Steel Machining

- More Material