The downward road of rebar will not be smooth

Since the second half of 2016, due to the strong efforts to ban “floor steel”, steel supply gaps have been created, and market inventories have remained low, making it difficult for steel prices to fall effectively in the short term. Therefore, the ban on "floor steel" has delayed the mid-to-long-term downward trend of steel prices. Coupled with the disturbance of limited production during the heating season, the market stays at the top of the arc longer. In addition, the demand side has not yet noticeably cooled down and has also supported steel prices. At present, the profit of steel mills is at a high level, and the market is afraid of heights. It is worried about the launch of new electric furnace capacity and the further tightening of monetary policy. Therefore, the steel market in the second half of 2017 is definitely not a "horse-horse".

At present, the impact of the ban on “land strip steel” on the market has not completely dissipated, which has kept the steel market inventory in 35 cities at a low level. As of June 30, 2017, the market inventory of the five major steel products was only 9.512 million tons, of which the long product market inventory was 5.022 million tons, which was almost the same as in the same period in 2016; the plate market inventory was relatively high, reaching 4.490 million tons, but recently There has been a rapid downward trend. There is a lot of controversy in the market regarding the actual production of "ground strip steel". According to different calculation methods, the annual output scale of "ground strip steel" ranges from 39 million tons to 100 million tons.

If measured from the perspective of the crude steel output of regular steel mills filling the gap of "ground steel", the actual output of "ground steel" determined by the high-low point yield difference method may be close to 100 million tons/year, given the current long-process capacity utilization The rate is no longer low. The blast furnace capacity utilization rate of the 163 steel mills surveyed by Mysteel is close to 90% after eliminating the obsolete capacity. It may take 9.3 months to fill the supply gap by increasing the production capacity of the blast furnace-converter. To fill the supply gap. Moreover, if steel production is disrupted for various reasons, it will take longer to fill the gap. The actual output of "ground strip steel" determined by the short-process steel mill capacity utilization method is roughly between 39 million to 70 million tons per year, and it still takes 3.7 to 6.6 months to fill this gap.

At present, in addition to the new production capacity of the blast furnace-converter process of Rizhao Steel, the capacity of the new growth process in 2017 is limited. If the launch of new electric furnace capacity is delayed, filling the supply gap will mainly rely on the existing long-term compliant production capacity. In any case, filling the gap requires steel mills to operate at full capacity for a long time. Moreover, filling the supply gap in the off-season will aggravate the supply shortage in the peak season. As for the scale of new electric furnace production capacity, it is also a problem with great uncertainty. The market is generally expected to be about 20 million tons/year. If these capacities are added to the ranks of filling the supply gap from the fourth quarter of 2017, the time to fill the gap can be shortened by about 0.5-1.3 months based on the calculation of the production scale of "ground strip steel". In summary, if the demand is relatively stable, it may take about 6 months to fill the gap.

In the medium and long term, the post-"floor steel" era is coming, and the post-"floor steel" era can be divided into two stages. The first stage is to increase the production of blast furnace-converter capacity to fill the gap caused by the ban on "ground steel", and the second stage is to fill the gap by the blast furnace-converter capacity and the electric furnace capacity. Recently, the society's attention to the steel industry has shifted from the supply gap caused by the suppression of "floor steel" to the new electric arc furnace capacity and the supply and demand situation of graphite electrodes consumed in the electric arc furnace production process. As long as there are still bottlenecks of one kind or another in the process of releasing electric arc furnace capacity, it is possible that the time when the supply gap is filled will be delayed, and the time for steel mills to maintain their profits in the prosperous stage will also be prolonged.

On the other hand, the "Beijing-Tianjin-Hebei and Surrounding Area 2017 Air Pollution Prevention and Control Work Plan"'s heating season production limit policy once again sounded the alarm of tight supply. From mid-November 2017 to mid-February 2018, the Beijing-Tianjin-Hebei air pollution transmission channel 2+26 urban high-pollution and high-energy-consuming industries' capacity utilization rate dropped to 50%, which means a large-scale shutdown. The shutdown of blast furnaces will cause molten iron and billets. resource crisis. In view of the current low inventory levels, supply contraction can easily cause market tightness again. At present, steel mills have made production adjustments based on the profitability of the varieties, and in the future will further tilt the iron water resources to the varieties with good profitability. The production lines of some varieties may completely stop production, and some varieties with good profitability may still be in full production.

According to the calculation based on the production line reaching rate of about 80%, the limited production during the heating season has caused a drop of 30-40 million tons of steel supply, which will affect the annual output by about 3%. The most affected varieties of restricted production are hot-rolled narrow steel strips, welded steel pipes, profiles, cold-rolled narrow steel strips, and medium-thick and wide steel strips. In contrast, the supply of rebar is not as limited as steel strips, welded pipes and profiles, and steel bars are less affected than wire rods and bars. If the supply gap caused by the ban on “floor steel” cannot be filled by the fourth quarter of 2017, it is very likely that steel mills will continue to tilt iron water resources toward long products. Environmentally-friendly production restrictions will help the plate market alleviate the pressure of oversupply.

In addition, the implementation phase of the environmental protection production restriction policy for the 2017 winter heating season coincides with the opening of the 19th National Congress of the Communist Party of China. According to past practice, a series of important meetings will last about two weeks, and the intensity of environmental protection supervision and environmental protection production restrictions is likely to increase. Prior to this, the 13th National Games will be held in Tianjin from August 27 to September 8, 2017. Even if the air quality in the Beijing-Tianjin-Hebei region is generally good from August to September, it cannot be ruled out that the pre-National Games will be added. The possibility of greater environmental protection supervision efforts. Objectively speaking, starting from mid-August 2017, steel production in North China may continue to be disrupted by various factors, and the timing of filling the supply gap will continue to be postponed.

However, because the environmental protection limit production in the heating season is aimed at blast furnace capacity, electric furnace production is not affected during the heating season. The new capacity of electric furnaces will fill a part of the gap caused by the limited blast furnace-converter capacity, and the new electric furnace capacity is mainly aimed at the long products market. The extent to which the supply of long products is affected will be partially neutralized. Due to the severe oversupply of scrap steel, scrap prices may not be very sensitive to the commissioning of new electric furnace capacity. It is necessary to focus on the operating conditions of short-process enterprises to determine the extent of potential supply release.

Monetary policy is moderately tightened, the effect of demand decline is lagging, and the effect of supply contraction is prominent

The current round of monetary policy tightening started in July 2016, but as far as the policy tightening trend as of May 2017 is concerned, measured by the trend line of M1 year-on-year growth rate, it is generally biased towards a moderate tightening. The other two monetary policy tightenings since the global financial crisis in 2009 have been significantly milder than those, and have limited restraint on economic activities. This is also the reason why the domestic manufacturing and non-manufacturing PMIs did not fall but rose in June 2017. The two rounds of monetary policy tightening in 2010 and 2013 lasted for 28 months and 21 months, respectively. Given that the current domestic economic growth is not far from the policy goal and the room for maneuver is relatively limited, the time for this round of policy tightening may also be It lasts for about 20 months, but the tightening process is not a uniform movement, and there have been stages of acceleration and deceleration in history.

The mild tightening of domestic monetary policy can be felt from the changes at the meso level. The most obvious is that real estate sales are still at a high level, and the scale of residential real estate mortgage loans has not shrunk sharply, but slowly declined. Due to urban real estate control policies, real estate sales in first- and second-tier cities have shrunk sharply, but third- and fourth-tier cities continue to promote the process of real estate destocking. The overall national real estate sales are still running at a high level. There is no significant decline in housing prices in 70 large and medium-sized cities in China. The newly-started area of real estate is still growing moderately, which is still conducive to maintaining high steel prices. The time when the real estate market peaked and fell, significantly delayed the downturn of the domestic economy. The current negative impact of demand on steel prices is still not obvious. Only when the national real estate sales shrink and house prices change from rising to falling, steel prices The fall pressure will increase significantly.

Comparison of the degree of domestic monetary policy tightening since 2008

In addition, demand is expected to have a greater disturbance to the market. Under the stimulus of the Xiongan New Area’s millennium plan, the market’s expectations of the government’s “doing fast and making a difference” may continue to ferment. Even if such expectations are falsified afterwards, they may also form a self-fulfilling style in the market. Actively replenish the rising market for inventory. However, the political cycle and the economic cycle are not highly consistent. The 2012-2013 new year's rising market was completed within the monetary easing cycle, while the background of the 2017-2018 new year's market was the currency tightening cycle. In the fourth quarter, the effect of this round of monetary tightening will gradually appear. Although the market will carry out cross-year speculation, it will still be obviously restrained by the monetary tightening environment.

Annual steel production (≥6 million tons) steel mill blast furnace operating rate and profitability

The mid-level and macro-level shock factors that existed in the fourth quarter should not be underestimated. In terms of mesoscale, steel mills of different sizes have different responses to price signals, which can be used as an important basis for judging the turning point of steel prices. Once large steel mills enter the ranks of resuming production and expansion, the market may not be far from the turning point.

The main contract basis of rebar and the fluctuation of rebar market inventory

The domestic economic growth rate has fallen, and downward pressure will suppress steel demand. Given that there are too many disturbance factors in the steel market in 2017, the downward price of steel will not be smooth sailing. The political cycle may stimulate the market's bullish expectations. At the same time, it will encounter production restrictions during the heating season. Constraints.

We expect that the RB1710 and RB1801 contracts will operate in the range of RMB 2800-3600/ton and RMB 2700-3500/ton respectively. In terms of intertemporal arbitrage, prior to the peak demand season in the spring and autumn, the strategy of long-term short-distance positive arbitrage is the main strategy. Since 2011, the basis repair market for rebar has generally existed at the end and the beginning of the year. Especially in the environment where the supply and demand is expected to resonate in the new year, it is more likely to fill the supply gap and repair the basis market.

Link to this article: The downward road of rebar will not be smooth

Reprint Statement: If there are no special instructions, all articles on this site are original. Please indicate the source for reprinting:https://www.cncmachiningptj.com

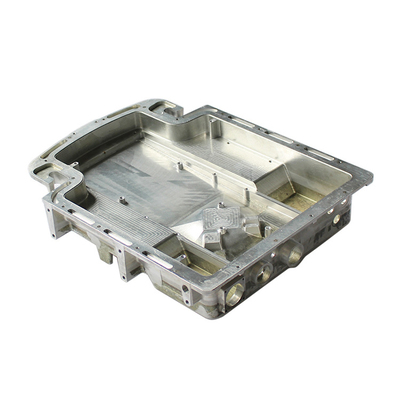

PTJ® is a customized manufacturer that provides a full range of copper bars, brass parts and copper parts. Common manufacturing processes include blanking, embossing, coppersmithing, wire edm services, etching, forming and bending, upsetting, hot forging and pressing, perforating and punching, thread rolling and knurling, shearing, multi spindle machining, extrusion and metal forging and stamping. Applications include bus bars, electrical conductors, coaxial cables, waveguides, transistor components, microwave tubes, blank mold tubes, and powder metallurgy extrusion tanks.

PTJ® is a customized manufacturer that provides a full range of copper bars, brass parts and copper parts. Common manufacturing processes include blanking, embossing, coppersmithing, wire edm services, etching, forming and bending, upsetting, hot forging and pressing, perforating and punching, thread rolling and knurling, shearing, multi spindle machining, extrusion and metal forging and stamping. Applications include bus bars, electrical conductors, coaxial cables, waveguides, transistor components, microwave tubes, blank mold tubes, and powder metallurgy extrusion tanks.

Tell us a little about your project’s budget and expected delivery time. We will strategize with you to provide the most cost-effective services to help you reach your target,You are welcome to contact us directly ( [email protected] ) .

- 5 Axis Machining

- Cnc Milling

- Cnc Turning

- Machining Industries

- Machining Process

- Surface Treatment

- Metal Machining

- Plastic Machining

- Powder Metallurgy Mold

- Die Casting

- Parts Gallery

- Auto Metal Parts

- Machinery Parts

- LED Heatsink

- Building Parts

- Mobile Parts

- Medical Parts

- Electronic Parts

- Tailored Machining

- Bicycle Parts

- Aluminum Machining

- Titanium Machining

- Stainless Steel Machining

- Copper Machining

- Brass Machining

- Super Alloy Machining

- Peek Machining

- UHMW Machining

- Unilate Machining

- PA6 Machining

- PPS Machining

- Teflon Machining

- Inconel Machining

- Tool Steel Machining

- More Material