Zinc rebound space is limited

Taking into account the acceleration of the resumption of production in overseas mines, the lower-than-expected downstream demand and the potential risk of inventory inflows in the bonded area, the rebound in zinc prices will bring better short-selling opportunities.

Last week, the long-term benchmark TC negotiations for zinc concentrates came to an end. The benchmark price of long-term zinc concentrates in 2018 fell by 14.5% year-on-year compared with 2017, which was the lowest benchmark price since 2006. Although TC still reflects the tight supply pattern, the trend of Lun Zinc is relatively weak. Taking into account the accelerated supply cycle changes of overseas mines, the lower than expected downstream demand and the potential risk of inventory inflows in the bonded area, the rebound in zinc prices is a better short-selling opportunity. It is recommended that the Shanghai Zinc 1807 contract be around 24,500-25,000 yuan/ton. Rebound short.

Accelerated production resumption of overseas mines

Under the logic that the shortage of zinc mines was transmitted to zinc ingots, the price of zinc started to rise. In 2016, the price of zinc increased by 56%, and in 2017 it increased by 23%. After two years of rising prices, the resumption and expansion of global zinc mine production far exceeded expectations. According to the forecast of ILZSG, global zinc mine production capacity will increase by 880,000 tons in 2018, and the growth rate of zinc mine supply will also increase from 3.6% in 2017 to At 6% in 2018, the growth rate has almost doubled. The blowout of zinc mine supply is mainly due to the resumption of production in large mines and the development of new mines, and the resumption of mine production accounts for as much as 63%. Among them, the tailings process of Australia Century Mine exceeded market expectations. New Century Resources Co., Ltd. claims that it will restart the tailings project of Century Mine in the third quarter of this year. The tailings reuse capacity is nearly 264,000 tons, which is almost half of the original production capacity of Century Mine. In 2016, the global zinc mine supply and demand gap was about 500,000 tons. In 2017, it was reduced to about 300,000 tons. In 2018, the newly added 880,000 tons of production capacity can fully cover the relative gap even if 50% of production is put into operation. The acceleration of overseas zinc mine production has led to global zinc The supply cycle changes ahead of schedule, and the long-term zinc price is difficult to be positive.

Hidden inventory risk should not be underestimated

Since the LME centralized delivery of nearly 100,000 tons occurred in March 2018, hidden inventory has been the focus of debate in the zinc market. If the centralized delivery in March is only accidental, then the delivery at the end of April can only show that the hidden inventory risk should not be underestimated. From April 25 to 26, LME zinc stocks continued to increase by nearly 50,000 tons. By monitoring the changes in LME zinc spot premiums and discounts (0-3), it can also be seen that the LME zinc spot premiums and discounts fell from US$17 on March 28 to US$-17.5 on April 24, a drop of 203%. The delivery of warehouses in April means that the hidden inventory has become more explicit, and it has also verified that the current expectations of oversupply have been realized ahead of schedule. LME spot premiums and discounts fell to 18.75 from May 1-3 at the lowest point, with a drop of 52% in just three days. It is not ruled out that the LME will usher in the possibility of further delivery. Hidden inventories will appear more frequently in the future, and zinc prices may have limited room for rebound.

Internal and external fundamental differentiation

What needs to be vigilant is that this year's domestic bonded zone inventory hit a record high, up to 256,000 tons, an increase of 100,000 tons compared to the same period last year. The import window opened for the first time after the Shanghai-London zinc price ratio rose last week. At present, more than 30,000 tons of imported zinc have flowed into the country. Since May, the reform of value-added tax is also one of the driving forces for the transformation of import profit and loss. After the Shanghai-London price ratio rises, more bonded zone zinc ingot declarations will flow into the country, and domestic zinc ingot inventories are facing huge potential risks. Although the spot premiums and discounts remain high, with the inflow of imported zinc, the spot premiums and discounts will come under pressure, which will bring certain suppression to zinc prices.

In addition, the current domestic and international fundamentals are divergent. During the LME closed, Shanghai zinc rebounded far beyond expectations. Under the guidance of the lack of Lun Zinc, Shanghai Zinc rebounded in revenge. On the one hand, it reflects the strong domestic fundamentals in the short-term, and on the other hand, it also reflects the speculative demand of the bulls. Taking into account the changes in the supply and demand pattern brought about by the acceleration of the resumption of production in overseas mines, the superimposition of hidden inventories and the risk of inventory inflows in domestic bonded areas, there is limited room for a short-term rebound in zinc prices. Operationally, it is recommended that the Shanghai Zinc 1807 contract be shorted every rebound at around RMB 24,500-25,000/ton.

Link to this article: Zinc rebound space is limited

Reprint Statement: If there are no special instructions, all articles on this site are original. Please indicate the source for reprinting:https://www.cncmachiningptj.com

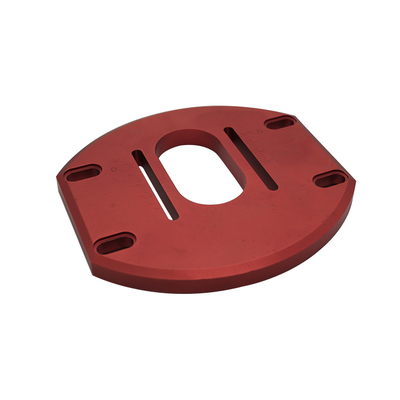

PTJ® is a customized manufacturer that provides a full range of copper bars, brass parts and copper parts. Common manufacturing processes include blanking, embossing, coppersmithing, wire edm services, etching, forming and bending, upsetting, hot forging and pressing, perforating and punching, thread rolling and knurling, shearing, multi spindle machining, extrusion and metal forging and stamping. Applications include bus bars, electrical conductors, coaxial cables, waveguides, transistor components, microwave tubes, blank mold tubes, and powder metallurgy extrusion tanks.

PTJ® is a customized manufacturer that provides a full range of copper bars, brass parts and copper parts. Common manufacturing processes include blanking, embossing, coppersmithing, wire edm services, etching, forming and bending, upsetting, hot forging and pressing, perforating and punching, thread rolling and knurling, shearing, multi spindle machining, extrusion and metal forging and stamping. Applications include bus bars, electrical conductors, coaxial cables, waveguides, transistor components, microwave tubes, blank mold tubes, and powder metallurgy extrusion tanks.

Tell us a little about your project’s budget and expected delivery time. We will strategize with you to provide the most cost-effective services to help you reach your target,You are welcome to contact us directly ( [email protected] ) .

- 5 Axis Machining

- Cnc Milling

- Cnc Turning

- Machining Industries

- Machining Process

- Surface Treatment

- Metal Machining

- Plastic Machining

- Powder Metallurgy Mold

- Die Casting

- Parts Gallery

- Auto Metal Parts

- Machinery Parts

- LED Heatsink

- Building Parts

- Mobile Parts

- Medical Parts

- Electronic Parts

- Tailored Machining

- Bicycle Parts

- Aluminum Machining

- Titanium Machining

- Stainless Steel Machining

- Copper Machining

- Brass Machining

- Super Alloy Machining

- Peek Machining

- UHMW Machining

- Unilate Machining

- PA6 Machining

- PPS Machining

- Teflon Machining

- Inconel Machining

- Tool Steel Machining

- More Material